what items are exempt from sales tax in tennessee

For instance a veterinarian may not be. Tennessee does not exempt any types of purchase from the state sales tax.

Sales Tax Holidays Begin In Tennessee Mississippi Fox13 News Memphis

Some goods are exempt from sales tax under Tennessee law.

. Some exemptions are based on the product purchased. Examples include some industrial machinery agricultural equipment fuel and medical supplies. In most states necessities such as groceries.

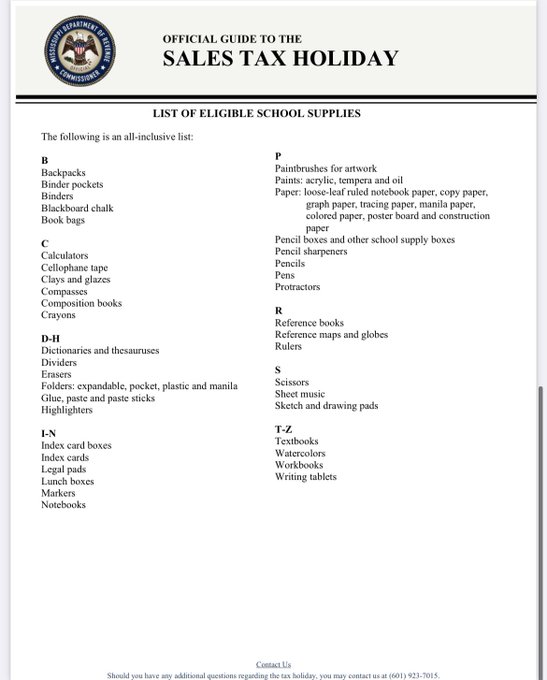

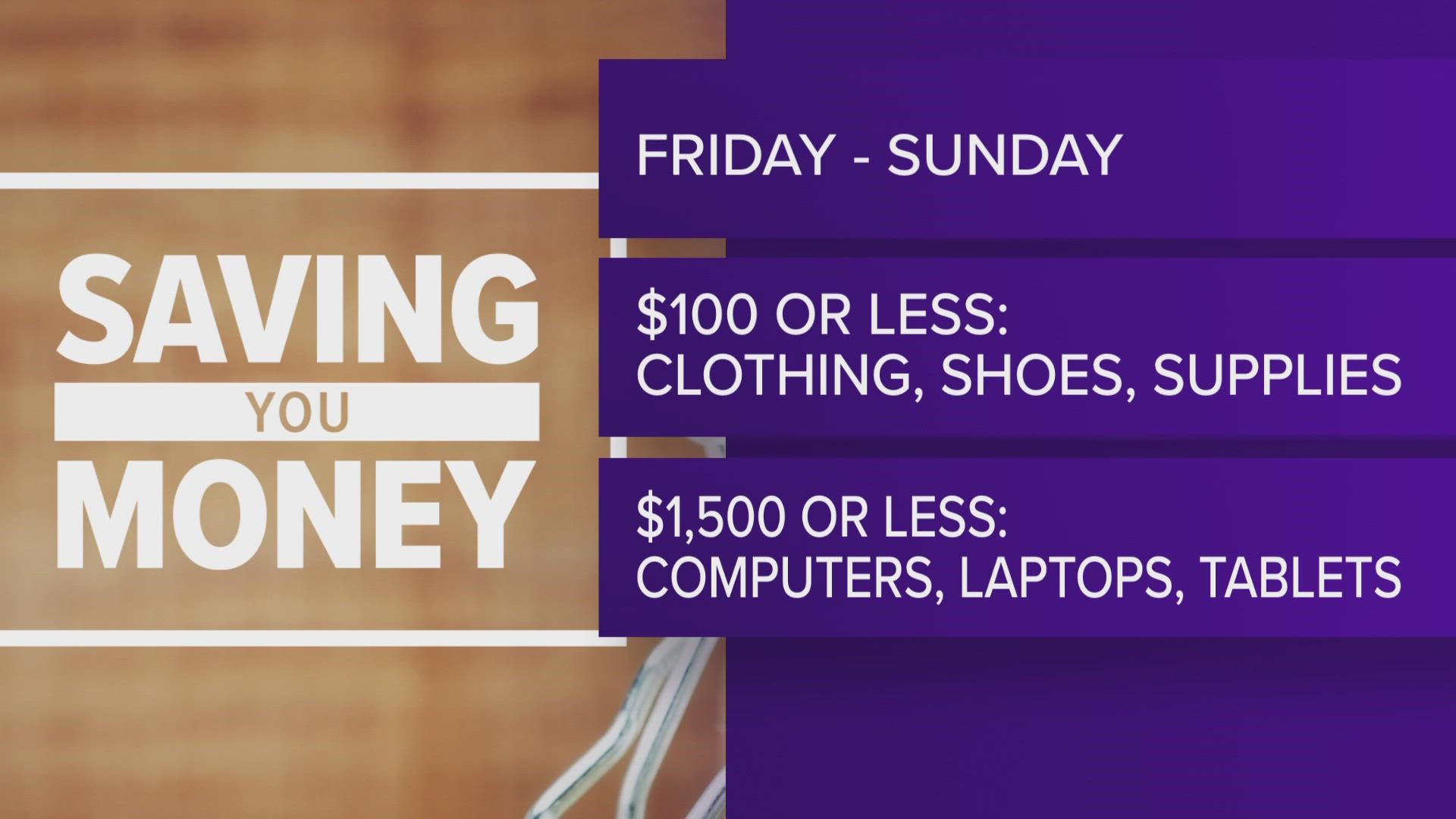

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along. School and school art supplies with a price of 100 or less. During the holiday the following items are exempt from sales and use tax.

Tennessee does not exempt any types of purchase from the state sales tax. Groceries is subject to special sales tax rates under Tennessee law. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in.

Textbooks and workbooks are exempt from sales tax. 43 rows In the state of Tennessee sales tax is legally required to be collected from all tangible. In the state of tennessee the exemption is applicable to used clothing which is being sold by some nonprofit organizations.

Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in. All individuals as well as businesses operating in the state must pay use tax when the sales tax was not collected by the seller on otherwise taxable products brought or shipped into. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and.

Businesses exempt from business tax for services rendered are not exempt when they sell otherwise taxable tangible personal property. Groceries is subject to special sales tax rates under Tennessee law. Clothing with a price of 100 or less per item.

For example gasoline textbooks school meals and a number of healthcare products are not subject to the. 12 -Tennessee Sales Tax Exemptions.

Tennessee Sales Tax Holidays What You Need To Know Wbbj Tv

Sales Taxes In The United States Wikipedia

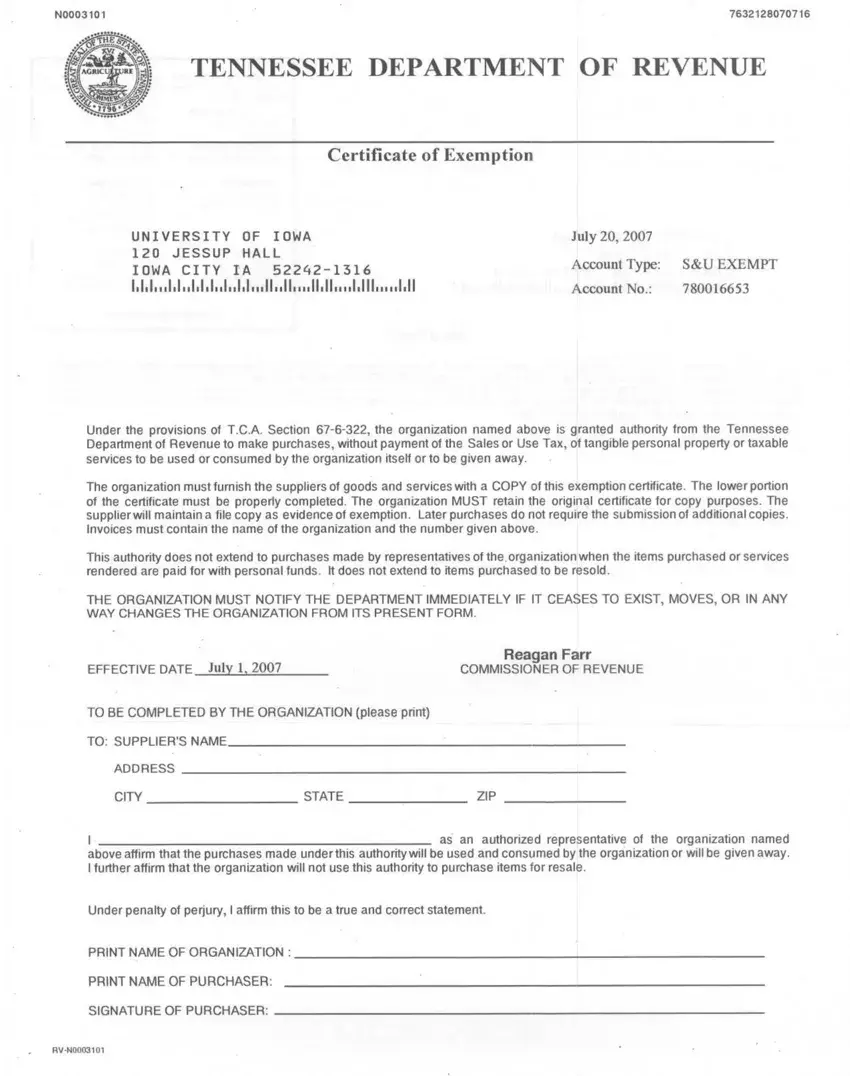

Tennessee Exemption Certificate Pdf Form Formspal

Tennessee Sales Tax Exemption For Manufacturers Agile Consulting

Knoxville News Sentinel Back To School Items Like Clothing Supplies And Computers Will Be Exempt From Sales Tax Beginning Friday July 29 Grocery Items Will Also Be Exempt From Sales Tax During The

Tax Free Weekend Starts Today News Thedailytimes Com

Tennessee Ag Sales Tax Tennessee Farm Bureau

Tax Free Weekend Kicks Off In Tennessee Wbbj Tv

Tax Free Weekend Coming To Tn Gibson County News

Time Again For Tennessee And Mississippi S Sales Tax Holiday Localmemphis Com

Tennessee Sales Use Tax Guide Avalara

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Tn Sales Tax Holiday Save Money On Groceries Guns School Supplies

Tennessee Guidance Issued On Sales Tax Holiday For Prepared Food And Food Ingredients

Get Ready To Save Three Sales Tax Holidays In 2022 Smith County Insider

Tennessee Announces Sales And Use Tax Moratorium On Broadband And Internet Infrastructure Investments

Your Guide To Tennessee S Tax Free Weekend 2022

Using The Tennessee Sales Tax Resale Certificate Youtube

Tennessee Groceries Will Be Tax Free For The Entire Month Of August Check Here For A List Of Included Items Thunder Radio